Solve for information asymmetry

April 11, 2021

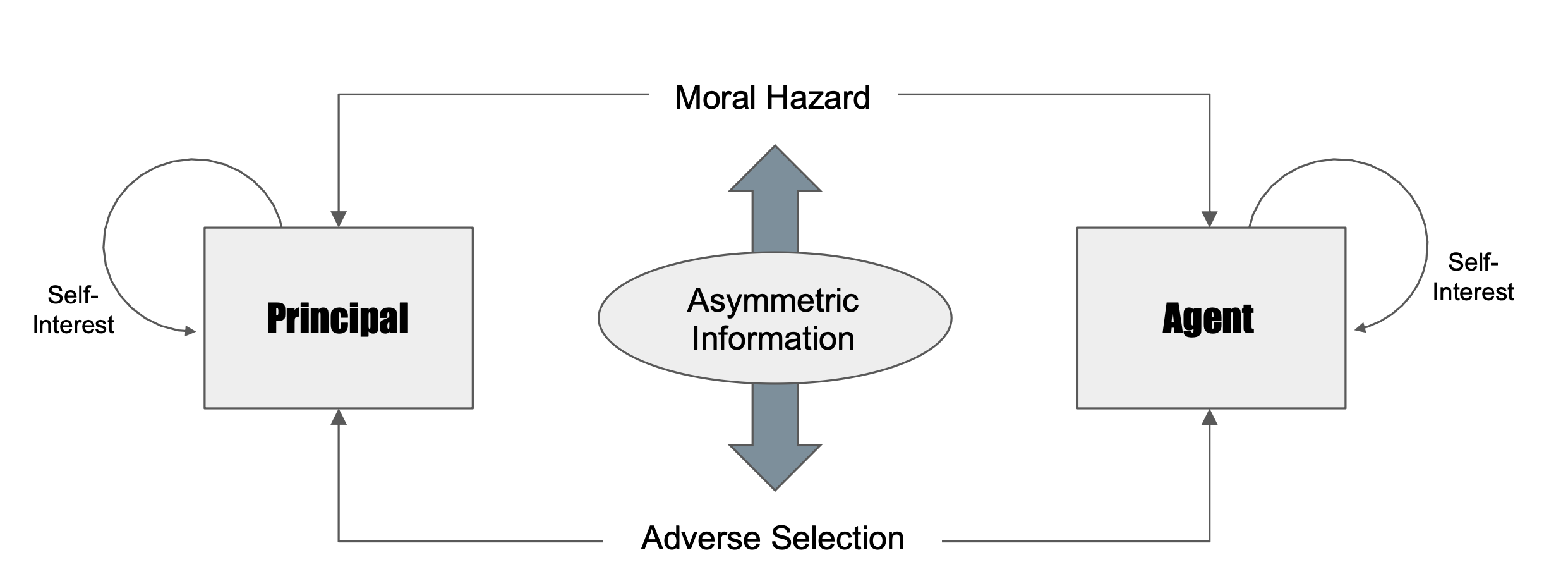

In economics, there is the concept of agency theory which describes an individual or a firm (principal/buyer) seeking out the service or advice of a professional (agent/seller). The professional can also be an individual or a firm. Common examples include hiring a contractor to complete an expansion on a home or retaining a counsel to provide legal advice. As the provider of a professional service, the seller may have more information on the true cost or length of time it takes to fulfill the service the buyer desires. Same can exist in reverse, where the buyer may have withheld certain information from the seller in order to obtain their services at a reduced price.

Agency theory also assumes both the buyer and the seller are motivated by their own self-interest and will pursue objectives that benefit themselves economically. Prior to an agreement or contract is formalized, either party can misrepresent the services being demanded or offered. Known as adverse selection, commonly seen in the used car market as an example, a seller may misrepresent the quality of a car and overcharge a buyer who does not have the insights into the actual quality of the car. CARFAX reduces adverse selection in used car markets by providing detailed history of a vehicle.

Moral hazard takes place once an agreement is in place, where one party willfully engages in a riskier behavior because the consequence of the excess risk is shifted to the other party in the relationship. A typical example of such risk-taking is an insured driver choosing to drive recklessly as they know the insurance company will cover the cost of repairing the damages that result from it. Auto insurers have been experimenting with usage-based auto insurance to combat moral hazard.

The dynamism of information asymmetry between the buyer and seller, fueled by self-interest, can lead to the less-informed party being exploited. Therefore, reducing information asymmetry is critically necessary in alleviating the issues of adverse selection and moral hazard in any buyer-seller relationship and the ability to make vital information available to all sides is tremendously valuable business proposition.

What information asymmetry will you solve for?